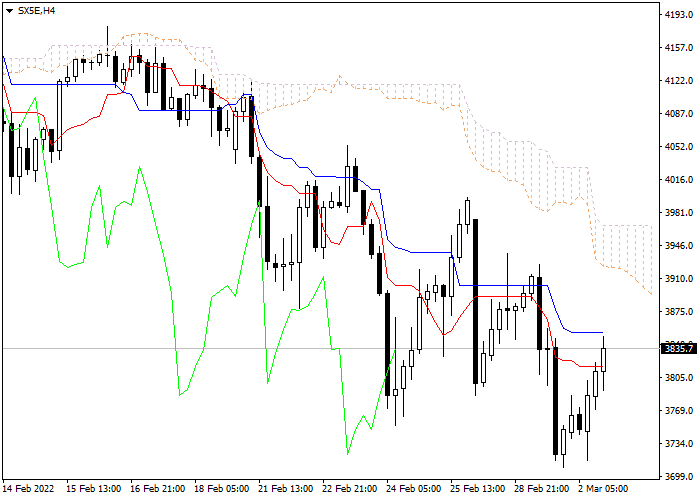

Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, the lines are horizontal . Confirmative line Chikou Span has crossed the price chart from below, current cloud is descending. The instrument is trading between Tenkan-sen and Kijun-sen lines. The closest support level is Tenkan-sen line (3808.4). One of the previous maximums of Chikou Span line is expected to be a resistance level (3833.9).

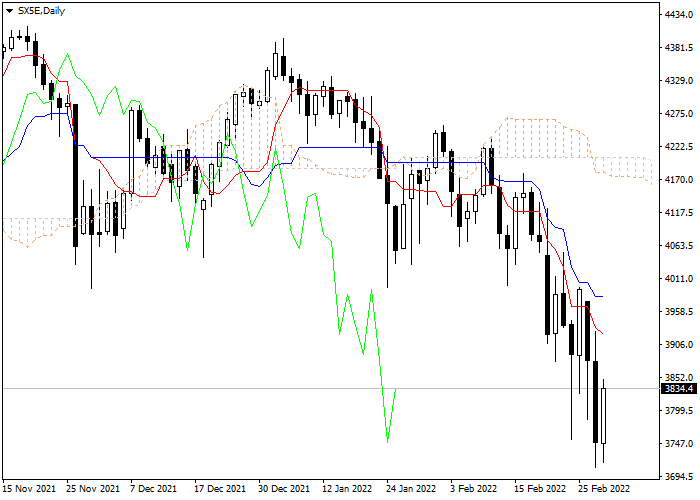

On the daily chart Tenkan-sen line is below Kijun-sen, the red line is directed downwards, while the blue one remains horizontal. Confirmative line Chikou Span is below the price chart, current cloud is descending. The instrument is trading below Tenkan-sen and Kijun-sen lines; the Bearish trend is still strong. One of the previous minimums of Chikou Span line is expected to be a support level (3796.6). The closest resistance level is Tenkan-sen line (3919.1).

On the both charts the instrument is still falling. It is recommended to open long positions at current price with the target at the level of previous maximum of Chikou Span line (3808.4) and Stop Loss at the upper border of the cloud (3833.9).

EUROSTOXX50 index

| Alış | Satış | Spread |

| 5674.3 | 5662.5 | 118 |

Scenario

| Time frame | Day's Range |

| Recommendations | SELL |

| Entry Point | 3834.9 |

| Take Profit | 3808.4 |

| Stop Loss | 3833.9 |

| Support levels | 3796.6, 3808.4, 3833.9, 3919.1 |

Alternative scenario

| Recommendations | |

| Entry Point | |

| Take Profit | |

| Stop Loss | |

| Support levels |

Bu sayfada yayınlanan içerikler, Claws&Horns Şirketi tarafından LiteFinance ile birlikte üretilmiştir ve 2014/65/AB Direktifi amaçları doğrultusunda yatırım tavsiyesi sağlanması olarak değerlendirilmemelidir; ayrıca, yatırım araştırmasının bağımsızlığını teşvik etmek için tasarlanmış yasal gerekliliklere uygun olarak hazırlanmamıştır ve bu tür araştırmaların yayımlanmasından önce işlem yapılmasına ilişkin herhangi bir yasağa tabi değildir.